26+ Reverse payroll calculator

Tax Management Automatically calculates files and pays federal state and local payroll taxes. All Services Backed by Tax Guarantee.

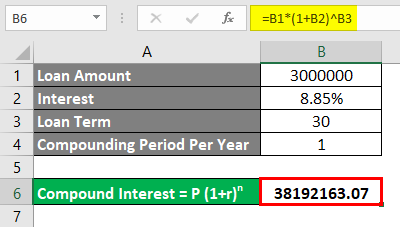

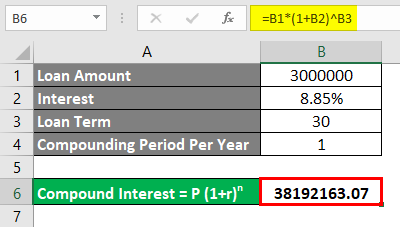

Calculate Compound Interest In Excel How To Calculate

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

. Time and attendance software with project tracking to help you be more efficient. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 50000 per year 52.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Time and attendance software with project tracking to help you be more efficient. Easy Online Run payroll from work home or the office.

This calculator helps you determine the gross paycheck needed to provide a required net amount. It uniquely allows you to specify any combination of inputs. Biweekly pay 48 weeks.

The weekly paycheck amount is given as. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. PAPR Pay period 52 for Weekly 26 for Bi-Weekly or 12 for Monthly. Then enter your current payroll information and.

Or Select a state. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax. Ad Payroll So Easy You Can Set It Up Run It Yourself.

2020 Federal income tax withholding calculation. Below are your federal gross-up paycheck results. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

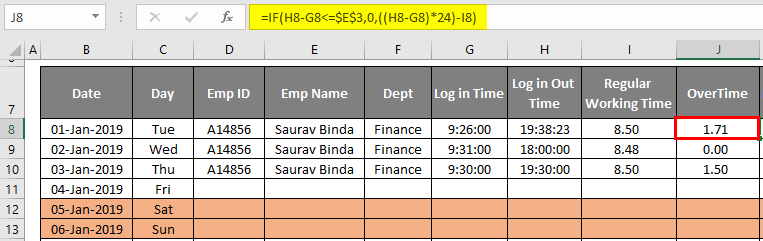

Take a Guided Tour. In case someone works in a week a number of 40 regular hours. Use this federal gross pay calculator to gross up wages based on net pay.

Example of a result. Hourly Paycheck Calculator. Paycheck Results is your gross pay and specific.

Subtract 12900 for Married otherwise. Discover ADP Payroll Benefits Insurance Time Talent HR More. Were making it easier for you to.

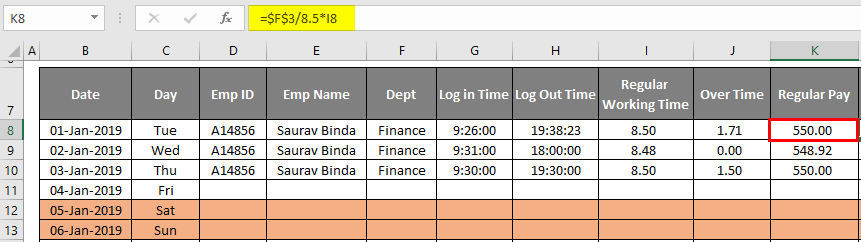

For this purpose lets assume some numbers. Ad No more forgotten entries inaccurate payroll or broken hearts. The annual salary in our case is 50000 and we work 40 hours per week.

The overtime calculator uses the following formulae. For example if an employee receives 500 in take-home pay this calculator can be used to. Finally calculate the Reverse Paycheck using the equation above.

Rules for calculating payroll taxes. Paycors Tech Saves Time. Ad Process Payroll Faster Easier With ADP Payroll.

Ad No more forgotten entries inaccurate payroll or broken hearts. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Federal Gross-Up Calculator Results.

If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck. Reverse Tax Calculator 2022-2023. Here When it Matters Most.

Our Expertise Helps You Make a Difference. This valuable tool has been updated for with latest figures and rules for working out taxes. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program.

First enter the net paycheck you require. Computes federal and state tax withholding for. Process payroll in 2 minutes or.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. AS WP 52. The US Salary Calculator is updated for 202223.

The results are broken up into three sections. Ad The Best HR Payroll Partner For Medium and Small Businesses. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. All other pay frequency inputs are assumed to. It will confirm the deductions you include on your.

Annual salary to hourly wage. First determine the weekly paycheck amount. Get Started With ADP Payroll.

Customized Payroll Solutions to Suit Your Needs.

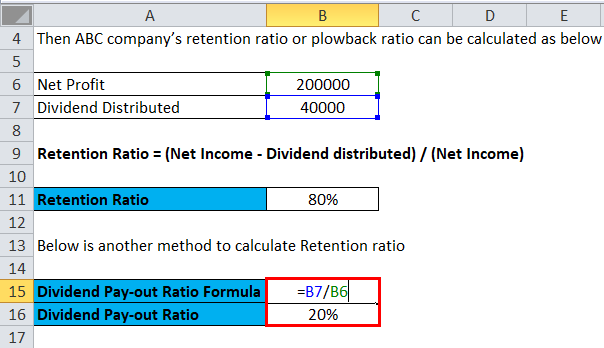

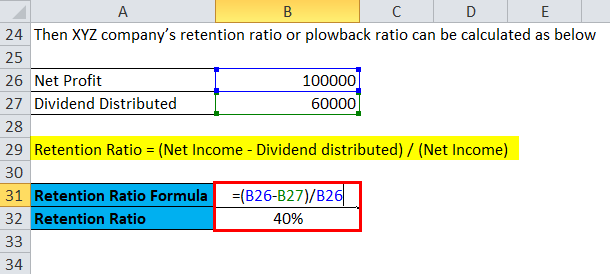

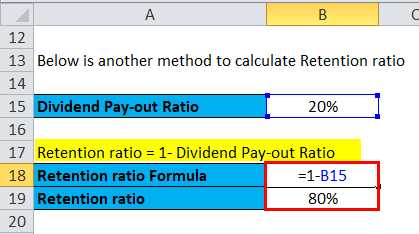

Retention Ratio Formula Calculator Excel Template

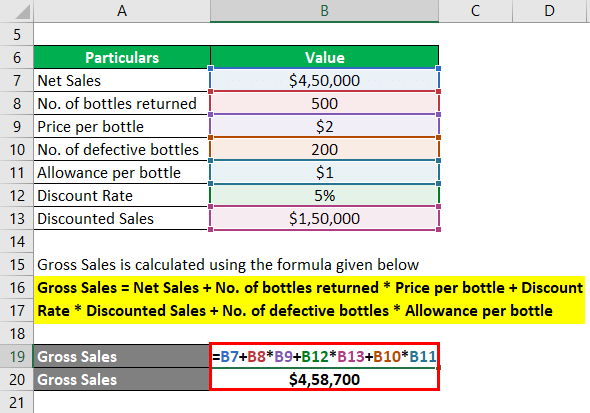

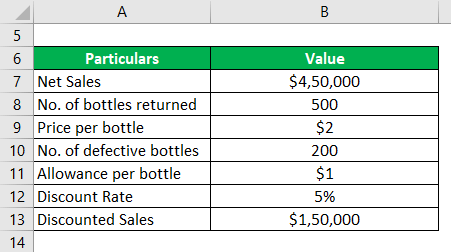

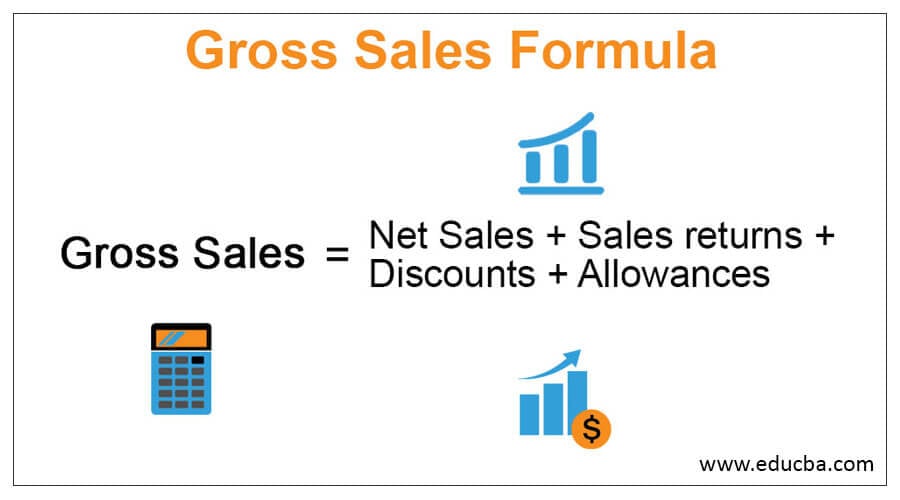

Gross Sales Formula Examples Of Gross Sales With Excel Template

Retention Ratio Formula Calculator Excel Template

Retention Ratio Formula Calculator Excel Template

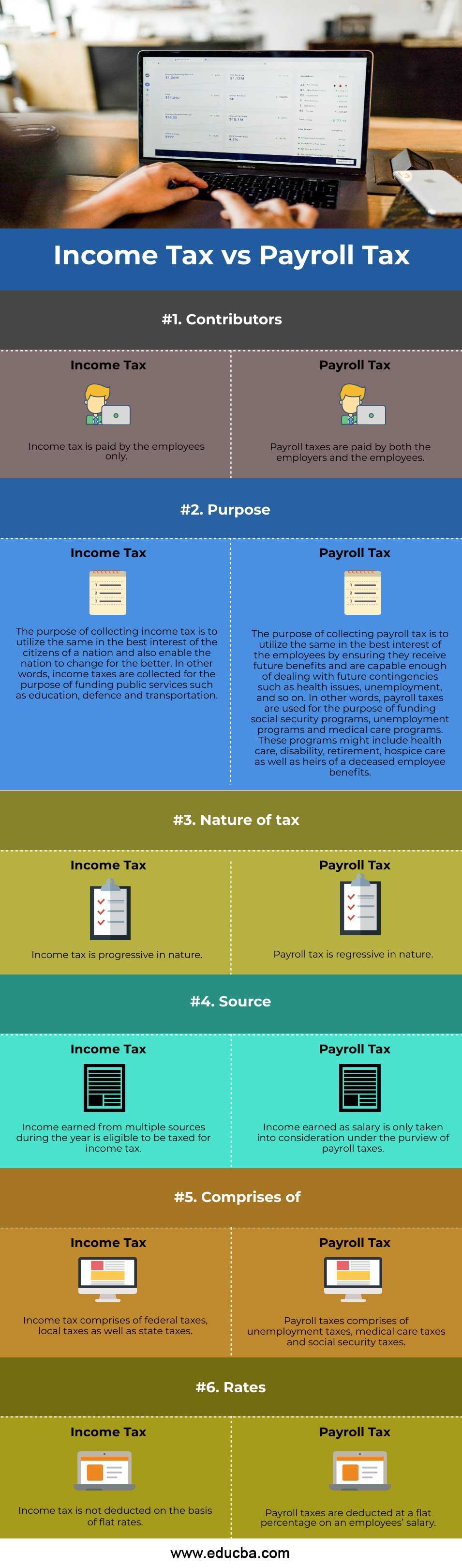

Income Tax Vs Payroll Tax Top 6 Differences To Learn With Infographics

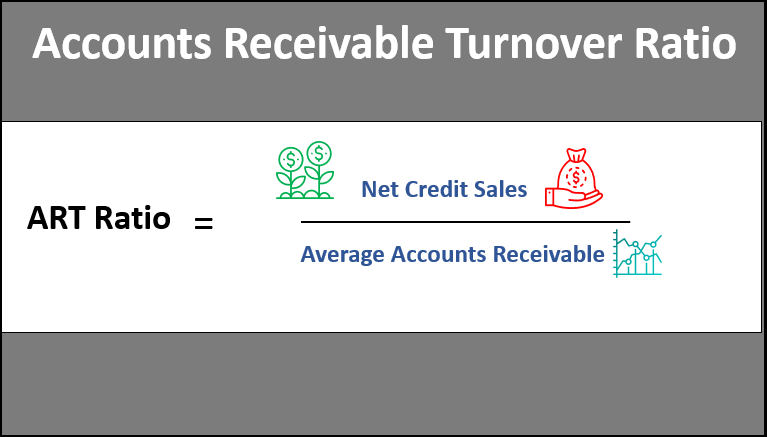

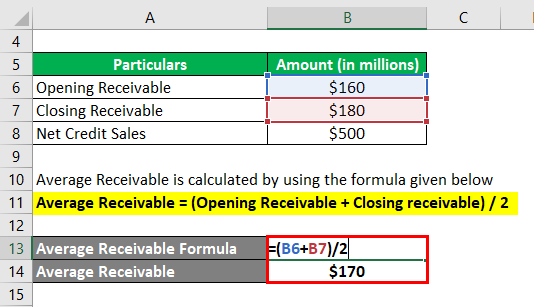

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

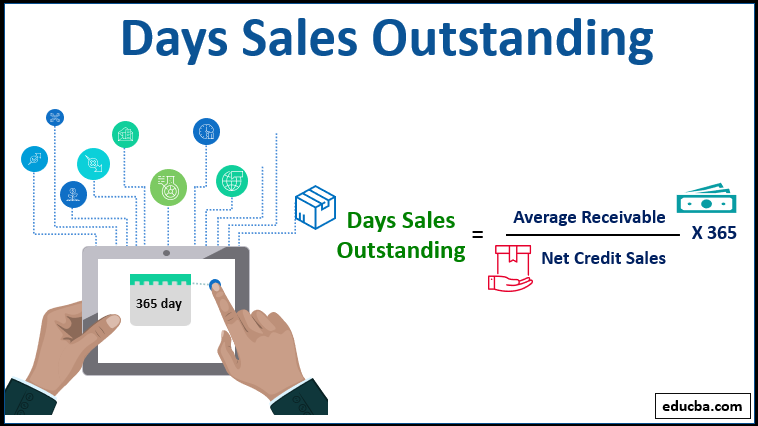

Days Sales Outstanding Examples With Excel Template Advantages

Ny Ovpq8eq6dsm

26 Week No Brainer 1 000 Savings Plan Start With 26 End With Exactly 1 001 26 Week Savings Plan Money Saving Challenge Budgeting

Gross Sales Formula Examples Of Gross Sales With Excel Template

Ny Ovpq8eq6dsm

Calculate Compound Interest In Excel How To Calculate

Income Tax Vs Payroll Tax Top 6 Differences To Learn With Infographics

Average Vs Weighted Average Top 7 Best Differences With Infographics

Days Sales Outstanding Examples With Excel Template Advantages

Gross Sales Formula Examples Of Gross Sales With Excel Template

Sum Of Year Digits Method Of Depreciation How To Calculate With Example