401k limit calculator

401k savings calculator helps you estimate your 401k savings at retirement based on your annual contribution and investment returns from now until retirement. Answer a few questions in the IRA Contribution Calculator to find out whether a.

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Small Business Credit Cards Travel Rewards Credit Cards

Free credit card payoff calculator for finding the best way to pay off multiple credit cards and estimating the length of time it would take.

. Their taxable income would drop to 77500. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution. A defined benefit plan as an alternative to a SEP IRA if you would like to contribute more than the 2022 SEP IRA limit of 61000.

Plans can set their own limits for how much participants can borrow but the IRS establishes a maximum allowable amount. We assume you will live to 95. 401k Catch-up Contribution Eligibility.

You only pay taxes on contributions and earnings when the money is withdrawn. Your household income location filing status and number of personal exemptions. 50 years or older.

In 2022 401k contribution. If your business is an S-corp C-corp or LLC taxed as such please consult with your tax professional. For example if you retire at age 65 your last contribution occurs when you are actually 64.

Solo 401k contribution calculation for a sole proprietorship partnership or an LLC taxed as a sole proprietorship. The limit is usually up to 50 of their account value or 50000 whichever is less. The good news is that this limit does not include employer match contributions.

Individual 401k Defined Benefit Plan or SIMPLE IRA. Remember that only employee salary deferral contributions can be put directly into the Roth 401k. Prior to 112020 an individual could not contribute after age 70½.

Catch-up Limit 50 years. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. We assume that the contribution limits for your retirement accounts increase with inflation.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Solo 401K Contribution Calculator. This simple 401k Calculator will show what role your 401k will play in plotting your path to your golden years.

Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. This federal 401k calculator helps you plan for the future. There are two options.

Not A Math Whiz. While a single credit card with a credit limit of 5000 only allows the cardholder to charge up to 5000 at a time having two cards each with a credit limit of 5000 will allow the cardholder to. Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. There is no income limit for a Roth 401k. Is there a limit on 401k loans.

Get the latest financial news headlines and analysis from CBS MoneyWatch. As a single filer that brings their top tax rate from. The contribution limit is inclusive of any contributions that you make to your Roth Solo 401k.

I put this spreadsheet together after receiving numerous requests for a spreadsheet that combined my 401k savings calculator with my retirement withdrawal calculator. You can find out how much your 401k will grow without the help of a financial wizard. In 2022 employers and employees together can contribute up to 61000 up from a limit of 58000 in 2021.

Plus many employers provide matching contributions. If you are 50 years old or older you can also contribute up to 6500 in catch-up contributions on top of your individual and employer contributions. The 2022 401k individual contribution limit is 20500 up from 19500 in 2021.

You might also consider opening an individual retirement account IRA to further build your savings. For 2021 your individual 401k contribution limit is 19500 or 26000 if youre age 50 or older. Contributions to a defined benefit plan are.

Our 401k Growth Calculator is a simple and easy way to estimate the long-term growth of your 401k retirement account by the time you want to retire. With a solo 401k you are allowed to make contributions in the role of employee and the role of. Please limit your response.

The Roth IRAs after-tax contributions so qualified. Fixed a bug where the Retirement Income in the. We automatically distribute your savings optimally among different retirement accounts.

I still consider this spreadsheet a work in progress but I think its finally at a point where people can try it out. Use our Calculator to calculate how much you could contribute to a SEP IRA based on your age and income. Your 401k plan account might be your best tool for creating a secure retirement.

The 401ks annual contribution limit of 20500 in 2022 27000 for those age 50 or older. This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401k on a pre-tax basis. Keep in mind though that you can only transfer in up to your total HSA contribution limit for the year meaning your IRA rollover is less a rollover and more making your HSA contribution for.

We stop the analysis there regardless of your spouses age. The contribution limit for those 50 and older is 26000 which includes the catch-up contribution limit of 6500. But if you have more than 5000 in a 401k at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on.

If you contribute say 20500 toward your 401k and your employer adds an additional 5000 youre still within the IRS. Roth 401k The Roth 401k is somewhat different from the traditional 401K as a retirement savings. If your plan permits loans you can typically borrow 10000 or 50 of your vested account balance whichever is greater but not more than 50000.

If you are in doubt about how much you can contribute as both an employee and an employer in your Solo 401k plan. The SECURE Act of 2019 removed the age limit at which an individual can contribute to a traditional IRA. For example consider a 55 year old with a 100000 pre-tax salary who contributes the maximum annual limit to their 401k in 2022 plus 2000 in catch-up contributions.

This calculator assumes that the year you retire you do not make any contributions to your 401k. Buy Car Calculator. How to use 401k calculator.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. Knowing how much your current 401k account may accumulate in the future can help you determine if you should adjust your annual 401k contributions to help reach your retirement goals. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Customizable 401k Calculator And Retirement Analysis Template

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Pin On Personal Finance

401k Contribution Calculator Step By Step Guide With Examples

The Maximum 401k Contribution Limit Financial Samurai

401k Contribution Limits And Rules 401k Investing Money How To Plan

Free 401k Calculator For Excel Calculate Your 401k Savings

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Investing

Employer 401 K Maximum Contribution Limit 2021 38 500

The Maximum 401k Contribution Limit Financial Samurai

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

What Are The Maximum 401 K Contribution Limits Money Concepts Saving For Retirement 401k

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

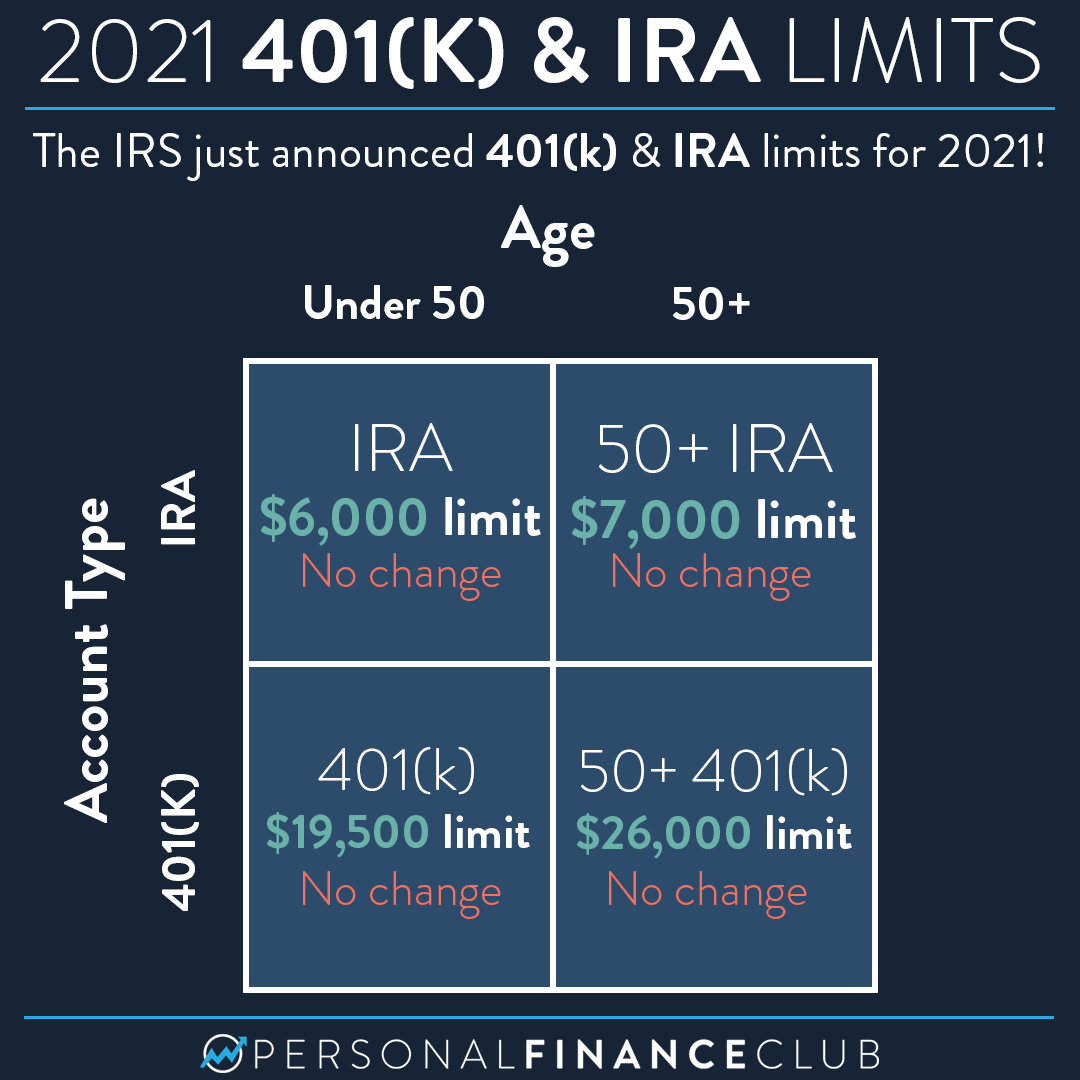

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Retirement Services 401 K Calculator